Contributions

You don’t pay any contributions directly to the L&G Master Trust, but instead agree to reduce your basic salary by an amount equal to the pension contributions you’d otherwise pay to the Scheme (called Salary Sacrifice). Contributing to your pension in this way is beneficial to both you and the Company from a tax and National Insurance contributions perspective.

For example, if you earn £30,000 per year and make a 5% employee contribution (the Company match your contribution with a 5% employer contribution):

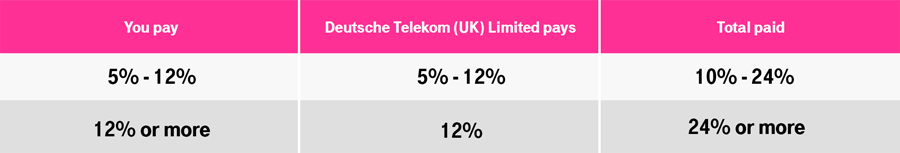

Currently, the options (expressed as a percentage of your pensionable earnings), are set out in the table below:

Can I change how much I pay?

You can change your contribution rate by giving the Company at least one month’s written notice. The Company will then adjust their contribution accordingly. To change your contribution rate, email HR at [email protected]

Can I make additonal contributions?

You can make an additional one-off contribution to your Account. If you’d like to make an additional contribution, you must notify the Company one month in advance by emailing HR at [email protected].

Disclaimer

No information contained in this site alters any member’s benefits or entitlement under the Scheme's trust deed and rules, which can be amended from time to time. In the event of there being any difference between the information set out on this site and the provisions of the Scheme’s current trust deed and rules, the latter will prevail.

T-Mobile International UK Pension Scheme Privacy Notice

GDPR Data Privacy Notice

For queries about your DC section benefits

contact the Pension Service Centre on:

Tel: 0800 368 68 68

Email: [email protected]

JOIN OUR MAILING LIST

Sign up to keep up to date: